How To: Sales Tax Rates

Trade Service Pro has a few options for configuring how sales tax is calculated.

Turning Sales Tax On/Off

Computing and adding sales tax to a job, proposal, or invoice can be turned on and off via a global system setting.

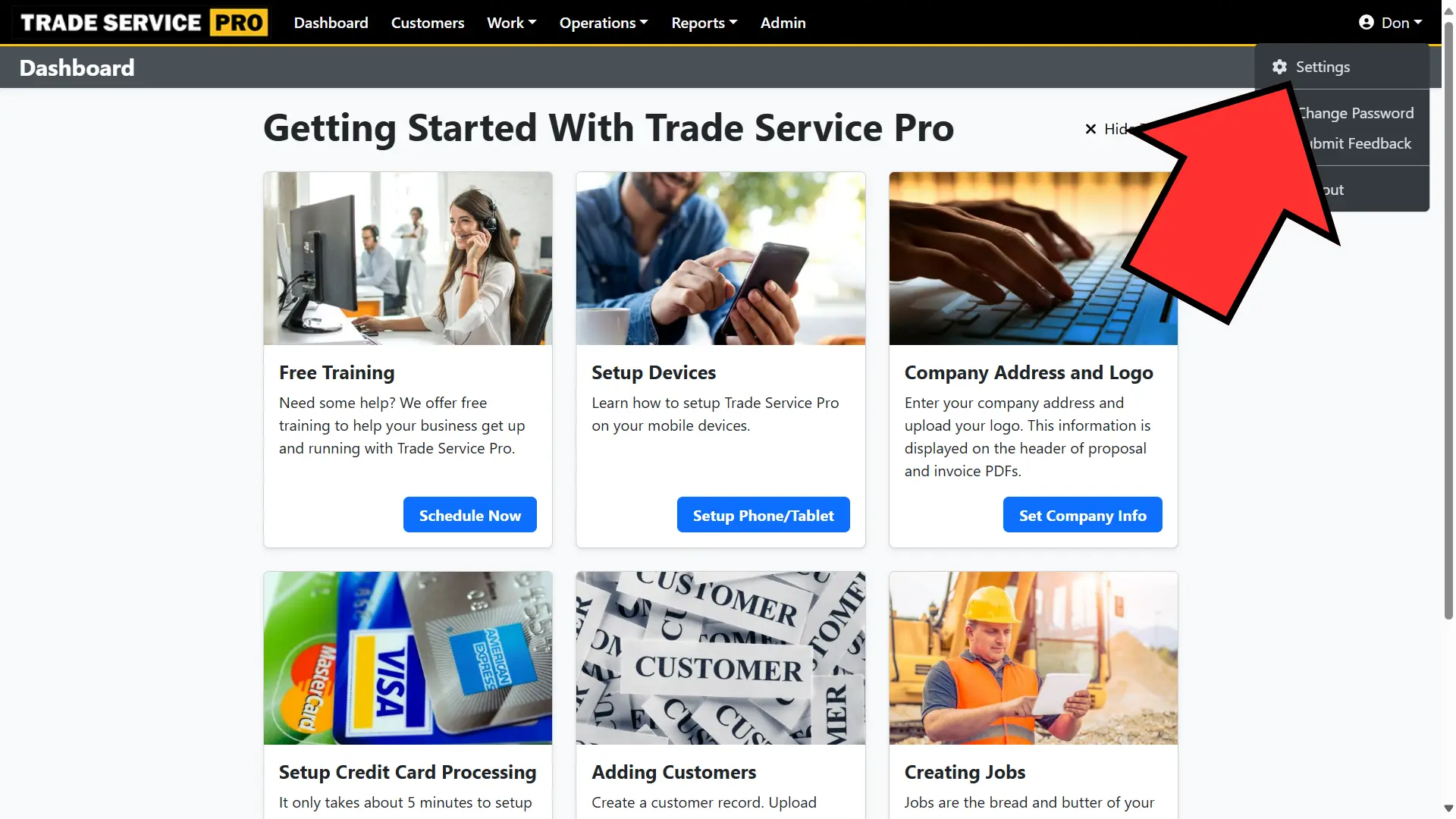

Start by clicking on your username in the top right of the screen. From the dropdown menu, select the Settings option.

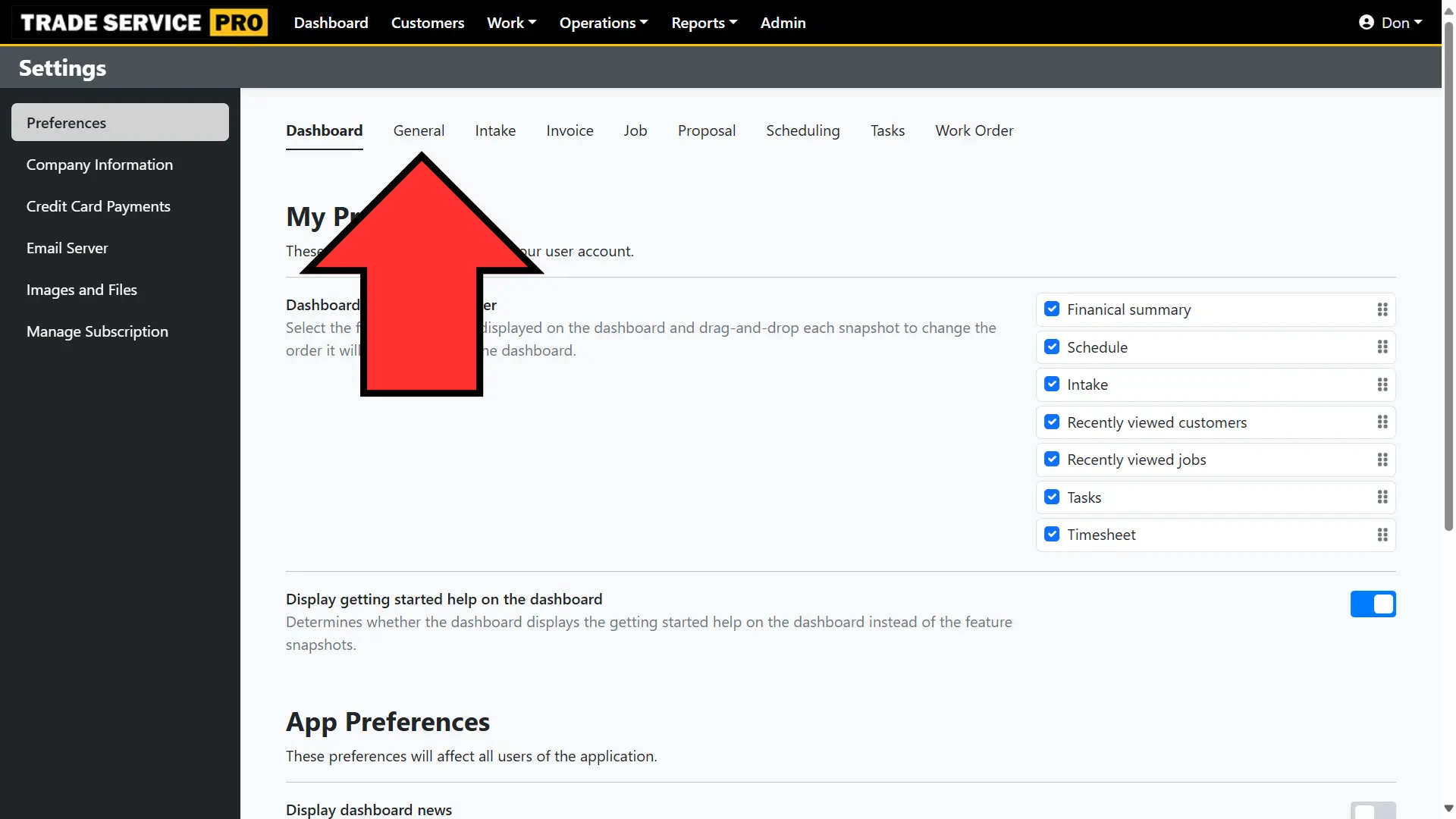

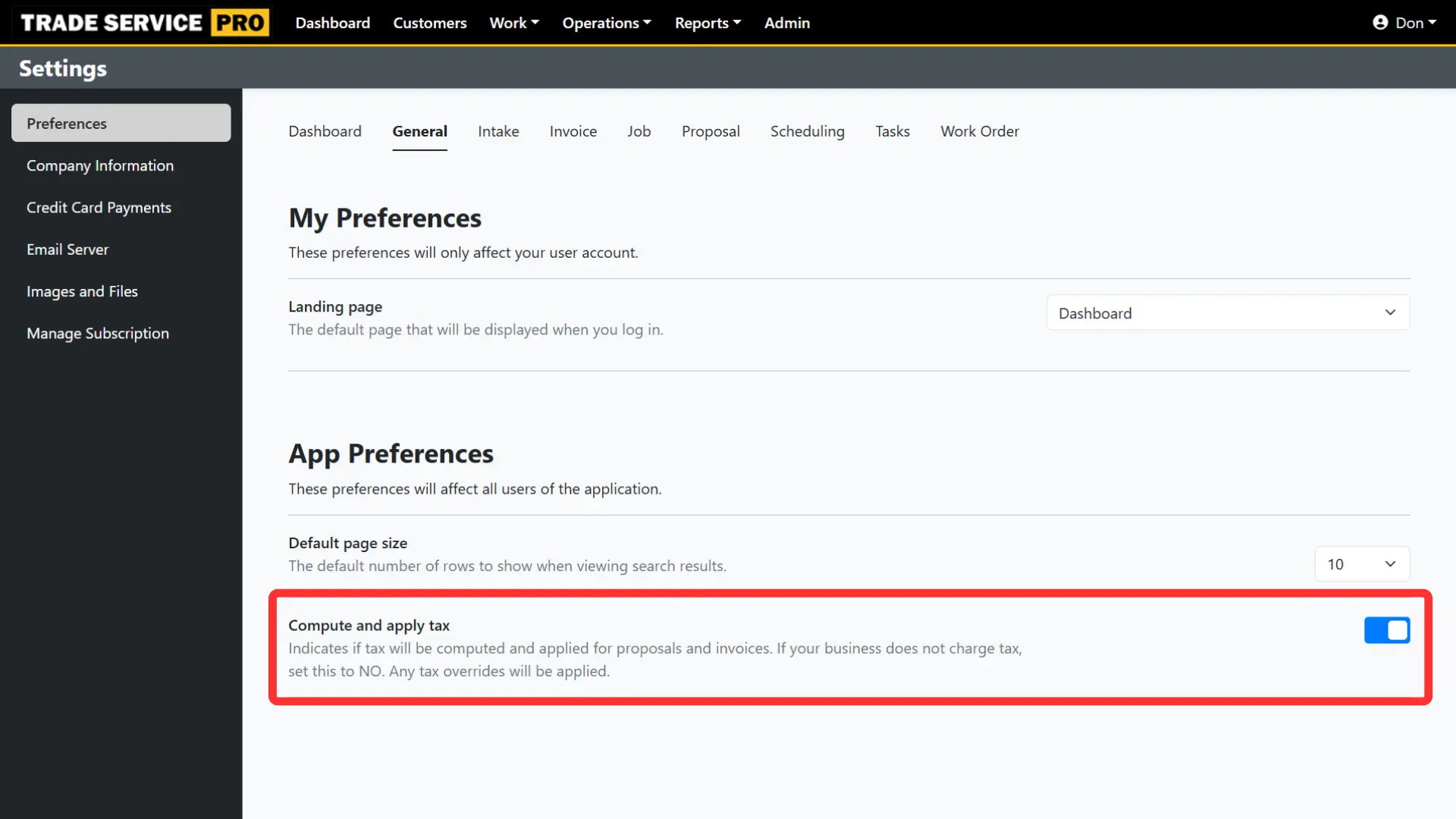

You will now be on the Settings page. The Settings page defaults to Preferences, which is where the setting for turning sales tax calculation on and off is located. Now click on the General tab.

On the General tab of Preferences is an option Compute and apply tax. This setting is on by default. If you turn this setting off, then sales tax will not be computed and will not be applied to jobs, proposals, and invoices.

Sales Tax Rate Lookup

If the application setting for Compute and apply tax is turned on, then the sales tax rate for a job, proposal, and invoice will automatically be computed and applied based on the zip code of the service address.

Let's look at the various sales tax rates in Pennsylvania for example:

- If the address has a zip code in Philadelphia, then a lookup will return an 8% sales tax rate (this is the rate as of 2024).

- If the address has a zip code in Pittsburg, then a lookup will return a 7% sales tax rate (this is the rate as of 2024).

- If the address has a zip code other than Philadelphia or Pittsburg, then a lookup will return a 6% sales tax rate (this is the rate as of 2024).

Tax Overrides

A customer can have a tax override set, or a tax override can be set on a per job basis. This can be useful for non-profit organizations, such as churches, so that sales tax will not be calculated or applied to any jobs, proposals, and invoices created for a customer with a sales tax override of 0%.

It is important to note that whether the application setting for Compute and apply tax is turned on OR off, that a tax override will still be applied.